Equity and Liabilities - the other side of the Balance Sheet

- grzegorzmichalski

- Aug 15, 2021

- 2 min read

Introduction

Last time we covered what the assets are – we said that they represent everything a company owns. Balance Sheet shows us also sources of financing of assets – these are the Equity and Liabilities. Together with Assets, they form the basic Accounting Equation:

Assets = Equity + Liabilities

Assets must always equal to equity and liabilities added together. This is due to the fact that a company cannot have more goods than the financing it obtained.

What is Equity? And what are Liabilities?

Equity – represents the capital invested into a company by its owners. It can consist of many elements, some of which are share capital, share premium, revaluation reserve, and so on. We will talk about those categories later.

Liabilities – represent the funding obtained from other sources, which the company is liable for. These can include mortgage to buy an office building; short-term credit to finance some day-to-day activities, accrued expenses from other periods. (We will talk about Accrual Accounting soon).

How can Liabilities be divided?

Liabilities can be, similarly to Assets, divided into two main categories – Current (short-term) and Non-Current (long-term). Current liabilities are those that the company is due to pay within 12 months. Non-Current liabilities are those with duration of more than 12 months.

Short-term liabilities – examples:

Short-term loan,

Overdraft on a debit card,

Lease payments,

Accrued income tax payable (Note 1),

Trade Payables (Note 2).

Note 1.

The term ‘accrued’ is derived from Accruals Accounting, about which we will talk soon. However, to let you understand it to some extent now, I will give an example of an accrued income tax payable.

Company ‘Accounting is Great’ had income tax expense for the year 2020 of £20,000, but none of this amount has been paid to the tax authority yet. The amount £20,000 representing income tax expense for 2020, will be accrued income tax payable in the Balance Sheet as at 31 December 2020. Why? Because the company has incurred this expense in the year 2020, but has not yet paid for it. Such amounts are registered as a short-term liability (the company has to pay the tax soon).

Note 2.

Trade Payables exist in a situation, when a company buys some goods, for example inventories (to see what inventories are, check the article about assets) in one accounting period, but will pay for them in the next accounting period.

Example.

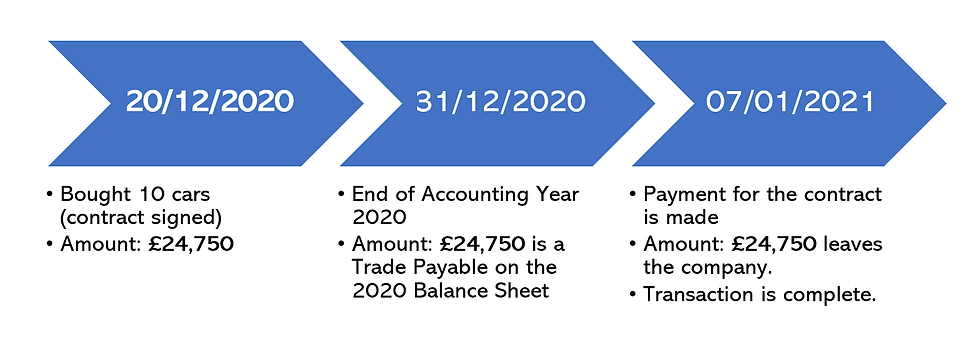

Car-dealing company ‘Cars for Everyone) bought 10 used Toyota CHR cars for £24,750 . Contract has been signed on 20 December 2020, but the deadline for the payment is 15 January 2021. Company pays for the cars on 7 January 2021. See the explanation below:

Long-term liabilities – examples:

Long-term loan to buy an office building,

Long-term loan to purchase manufacturing equipment,

Long-term debt contract payable.

Summary:

Equity and Liabilities represent the sources of funding the company has.

Equity represent what has been invested into a company by its owners

Liabilities represent what the company owes or what it is liable for.

Equity is mainly formed from share capital, share premium, retained earnings, but can be formed from more elements.

Liabilities can be divided into long-term and short-term depending on the duration of the liability (whether the company is to pay the amount within less or more than 12 months).

Comments